The Kristoff Team

Getting the 4% Property Tax Rate

Getting the 4% Property Tax Rate

Share

An important part of making South Carolina home is applying for the 4% owner-occupied property tax rate. We get questions from clients all the time about how to apply for the reduced rate so we compiled a simple guide to help you navigate the process.

5 Simple Steps:

- Check the guidelines for eligibility and required documents at the Beaufort County website

- Complete the Online Legal Residence Special Assessment Ratio Application OR PDF Legal Residence Special Assessment Ratio Application

- Return the application and necessary documents online or to the Beaufort County Assessor's office:

Bluffton Office:

4819 Bluffton Parkway, Bluffton, SC 29910

3rd Floor - Check the status of your application by visiting the Exemption Viewer or the Beaufort County Property Records and searching for your property.

- Have a mortgage that is escrowed? Once the taxes have been updated, send a copy of the corrected bill to the Escrow Department of your mortgage company so they can update their records.

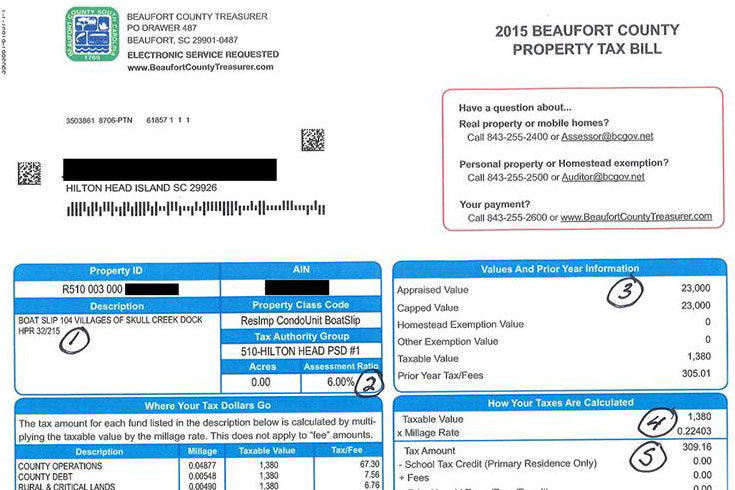

Sample Beaufort County Property Tax Bill

(for illustrative purposes only)

Instructional Video from Beaufort County, SC

Beaufort County's Video on The Roll of an Assessor: