The Kristoff Team

Debt-to-income ratio impacts interest rate!

Debt-to-income ratio impacts interest rate!

Share

UPDATE - March 15, 2023 - Implementation of the Debt-to-Income Loan-Level Price Adjustment has been delayed until August 1, 2023. See the full statement from FHFA here.

*******

Fannie Mae recently announced changes to their Loan-Level Price Adjustments (LLPAs) including debt-to-income ratio as a characteristic that will impact a borrower's interest rate!

What are Loan-Level Price Adjustments (LLPAs)?

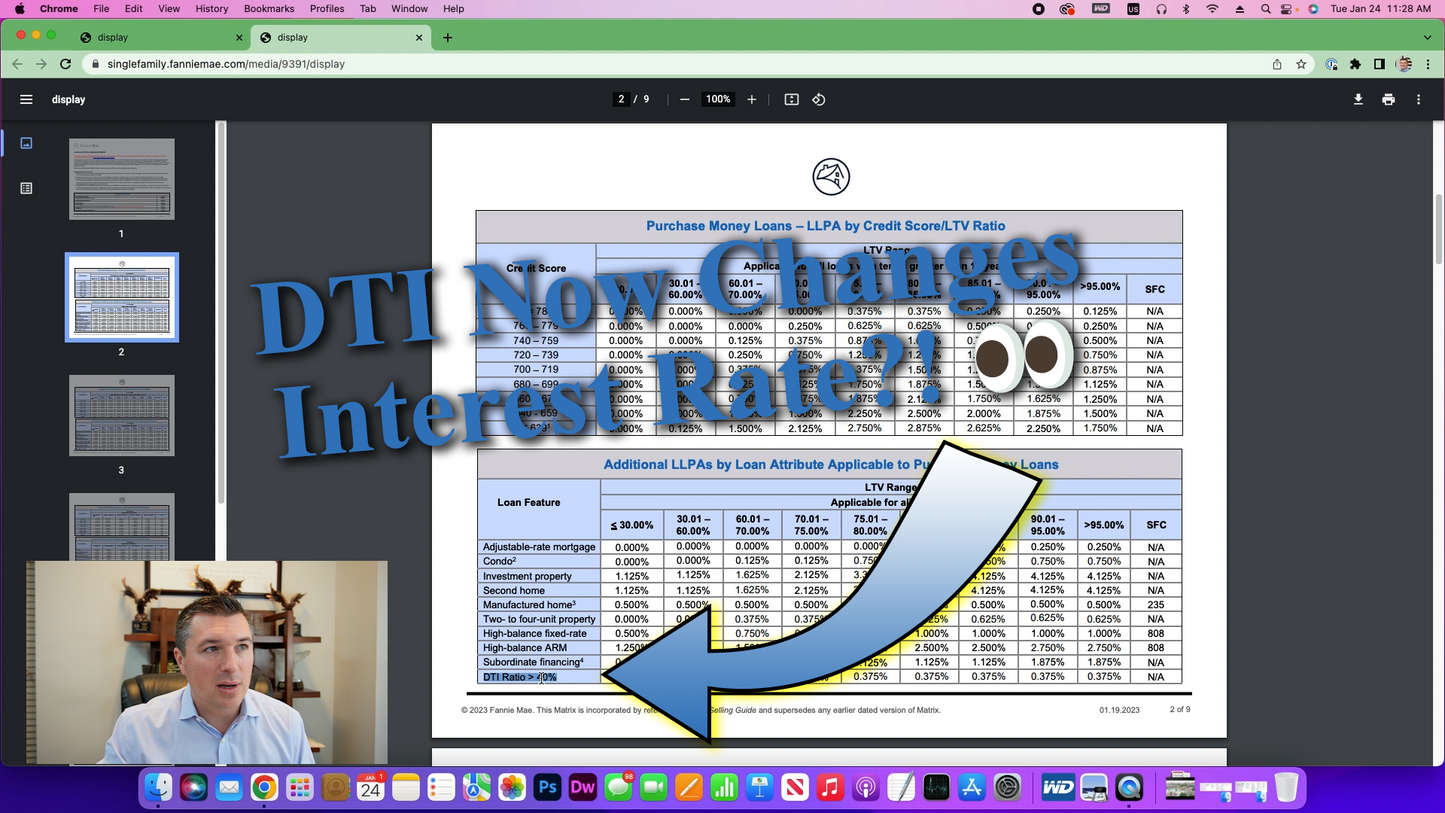

LLPAs are how the mortgage industry, particularly Fannie Mae and Freddie Mac, make adjustments to the interest rate based on specific criteria within the loan. If two borrowers apply for a Fannie Mae 30-year fixed-rate loan on the same day from the same mortgage company you'd expect they'd get the exact same rate, right? Well, what if one borrower has a 620 credit score and 5% down payment while the other borrower has an 800 credit score with a 40% down payment. Would you still expect them to have the same interest rate? Probably not. However, if they have both applied for a 30-year fixed-rate mortgage how does Fannie Mae adjust the rate such that the higher-risk borrower (620 credit score with 5% down payment) receives a higher interest rate than the lower risk borrower (800 credit score with 40% down payment)? The answer is with with Loan-Level Price Adjustments. Fannie Mae will make an adjustment to the price (think paying points) for riskier loans. Borrowers can either pay those points directly or, more often, they receive a higher interest rate based on the total of the LLPAs.

What characteristics of the loan does Fannie Mae have adjustments for?

There are numerous adjustments that have been established for a long while. Occupancy (for example: primary residence vs. investment property), credit score, down payment percentage, property type (e.g. single-family home vs. condominium), subordinate financing, purpose (e.g., purchase vs. cash-out refinance), etc. Each of these characteristics may have a corresponding LLPA and they are all totaled up to determine the overall adjustment applicable to the loan. Click here for the full list of Fannie Mae Loan-Level Price Adjustments

Why is the Debt-to-Income Ratio Loan-Level Price Adjustment Unique?

If Fannie Mae and Freddie Mac have had these price adjustments in place for years what's the big deal about the change? If you think about the characteristics of the loan that generate price adjustments they almost exclusively characteristics the borrower and/or loan officer would know at the beginning of the process. If an individual is buying a single-family home vs. a condominium the buyer would know that upfront. The loan officer would pull credit at the beginning of the process (or before if the buyer got pre-qualified). The amount of down payment changes if the buyer decides to put in more or less cash. They are all changes known at the beginning of the process or made with the borrowers involvement. This means the borrower can make a decision about rate at the beginning of the process and based on key decisions he/she makes during the process.

The debt-to-income ratio is different, it is calculated throughout the process by the underwriter. Income is updated as paystubs are collected, tax returns are analyzed, verifications are obtained from employers, etc. Similarly, the expenses change as homeowner's insurance quotes are obtained, property taxes are calculated by the settlement agent, homeowner's association dues are obtained, etc. Both the "debts" and "income" are continually being updated as the loan is processed and underwritten. Therefore, its possible to get up to the end of the loan approval process and get a homeowner's insurance bill that pushes the debt-to-income ratio over the 40% threshold. That change would then impact the interest rate!

As lenders we want to avoid surprises at then end of the process, but Fannie Mae's changes to the LLPAs such that rate is impacted by the borrower's debt-to-income ratio may lead to unavoidable last-minute changes. Our goal is to work to obtain as much information early in the process to avoid these surprises. As a real estate professional you'll want to prepare your client to get information to their lender as quickly as possible.